India’s Top 10 Neobanks in 2023

When it comes to financial technology and banking in India, there’s no shortage of competition. Neobanks are gaining ground in India. It’s also enlightening to observe the innovative approaches they take to solving the problem.

The financial system we now have in place is not fit for the long term. Neobanks, on the other hand, are simple to use, safe, and cost-effective compared to standard banking options. Many Neobanks are now considered one of the top banks in India.

About neobanking in India

This cutting-edge banking approach is reshaping the banking and Fintech sectors with neobanking, Digital-only banks are known as Neobanks. The deposit of cash is not required, nor is there any supporting documents.

As a result, a Neobank is not a bank in the eyes of the RBI. It’s important to note that none of the following services purport to be banks. It’s a collection of applications and services for managing your money. They can’t hold your money since they don’t have the infrastructure to do so.

Basically, what these Neobanks are doing is making life a little bit simpler for the people who use them. As far as documentation goes, you won’t have to deal with anything. In comparison to traditional banks, assistance is far more expeditious; the application is current, and you don’t have to pay additional fees.

There are no physical branches of Non Banks in India, but they offer a wide range of services not offered by their competitors or traditional banking. They employ artificial intelligence and machine learning to give individualized financial services to customers while also reducing operational expenses.

Need of Neobanks

There has been an explosion in the number of neobanks, which operate solely online and do not use physical branches or traditional back-ends. However, it is possible that neobanks will have an impact on the $850 billion annual SMB banking market, which has been neglected by traditional banks.

With their cutting-edge technology and absence of pricey branch locations, Neobanks can handle the needs of small and medium-sized businesses significantly more effectively than their traditional counterparts. neobank’s primary features include fast registration, multi-tiered accounts, and integration with third-party tools like bookkeeping and accounting software.

Top 10 Neobanks in India 2023

1. Jupiter

Jitendra Gupta is one of the company’s original founders. The company was founded in 2019 and has been doing well ever since. India’s leading neobank, Jupiter, has a strong presence throughout the country.

As a digitally savvy bank, Jupiter strives to meet the needs of its customers. Fintech firm Jupiter allows consumers to open bank accounts all around the world. Jitendra Gupta founded the company.

Techcrunch reports that Indian neobank Jupiter has raised $86 million in funding to deliver lending and wealth management services.

Official Website – jupiter.money

2. RazorpayX

Harshil Mathur and Shashank Kumar founded Razorpay in Bangalore in 2014. As an API and dashboard platform for merchants, Razorpay quickly became a game-changer in the digital payments industry. Enterprises that have an influence on and drive payment ecosystems may now do so from a single location.

Check – Indian Banking GK Questions and Answers

It is possible to automate payroll, set up recurring payments, and manage invoices and payments with Razorpay. The credit limit for corporate expenditures is increased, and it is simpler to keep track of and administer corporate expenditures as a result.

There have been eight rounds of funding totaling $366.6 million for RazorPay’s parent company. An important group of investors includes Salesforce Ventures as well as Matrix Partners India, GIC (Global Investment Corporation), Combinator (The Investing Company), and Ribbit Capital (India).

Payout links are launched by razorpay, which automates money transfers without the need for bank account information.

Official Website – x.razorpay.com

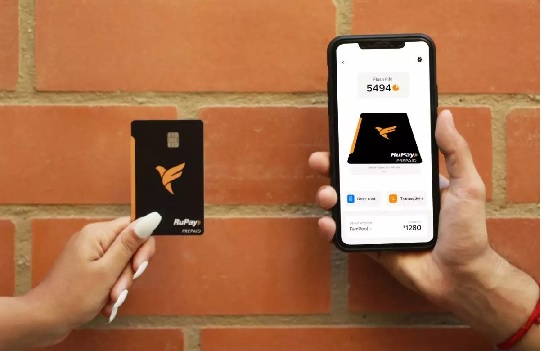

3. FamPay

It is the country’s first neobanking app for teenagers. This neobank may be used by teenagers while their parents are nearby. IDFC First Bank’s FamCard is a secure card with no personal information stored on it.

Paying on numerous services, such as Netflix, Zomato and Swiggy may be done in a matter of seconds using FamPay. With the aid of FamPay, kids may gain financial independence at an early age and learn how to budget their money wisely. At this time, the neobank has over 2 million customers.

In India, 40% of the population is under the age of 18, and FamPay aspires to be the brand of choice for millions of teenagers who start using their smartphones each year.

Official Website – famapp.in

4. InstantPay

Reports say InstantPay is the most popular net banking platform in the country. As a financial institution, it serves people and companies of all sizes. A daily average of nearly one million transactions is handled by Neobank.

InstantPay’s API can be integrated with accounting systems so that businesses may easily make financial transactions. Companies may utilize the API to automatically grow from $0 to a million dollars each day.

ICICI Bank, Axis Bank, IndusInd Bank, and Yes Bank are just a few of the well-known Indian financial institutions that InstantPay has partnered with. There is no minimum balance requirement when using InstantPay to establish a digital account and make use of services like.

Official Website – app.instantpay.in

5. Fi (Fi. Money)

The Fi App looks to be well-designed and has an excellent user experience. For the time being, it’s only available on Android-powered devices. Customers have been pleased with the amount of activity thus far.

A bank account may be opened in a matter of minutes. To get a Fi.nite code, you must first sign up for their waitlist. Once you get your code, you can use it to register for the Fi app. The software also allows you to see a history of your purchases.

Free VISA debit cards will be provided. A single click can allow you to withdraw cash, conduct online transactions, use PayWave, and restrict it.

NEFT, IMPS, and RTGS transfers are completely free of cost. In addition, you’ll get two free checkbooks per quarter. To top it all off, there are no foreign currency expenses.

6. Akudo App

“Peaceful Wealth” is the name of the country’s first neobank for young people, Akudo. Currently, neobanking is striving to empower young people with financial independence through appealing to a younger clientele.

Those under the age of 18 can receive a prepaid debit card that they can use even if their parents are around. In addition, the neobank allows parents to manage their children’s spending, which serves as an additional deterrent to unnecessary spending.

Furthermore, in a gamified environment, young people are encouraged to develop a saving habit by offering tempting rewards.

Official Website – akudo.in

List of Best Online Banks

7. Niyo

Founded in 2015 by financial system and payments expert Vinay Bagri Virender Bisht, the company’s objective is to “Make Banking Smarter, Safer and Simpler.” As a bank, Niyo provides a wide range of services, including:

Niyo X is a useful program that offers users a variety of ways to save and make financial decisions. With the help of Robo-advisors, Niyo Money helps consumers develop and manage their wealth.

Customers of Niyo Global may look forward to 24-hour customer support and interest rates of up to 5%. The open banking platform, Niyo Bharat is an app that provides employees with a salary card via their smartphones.

Official Website – goniyo.com

8. OcareNeo

By using the tagline “Your Digital Health Passport,” Dr. Neeraj Sheth founded the company. Access to personal and family patient data as well as financial information is made simple with OCareNeo.

Medical records and payment data are stored in a QR code, a Digital Card, and a Digital Piggy Bank, which may be used to pay medical costs and save for the future. OCareNeo also provides consumers with a variety of safe and insurance goods to help them keep their health in check.

Official Website – ocareneo.com

9. Atlantis (Neo-bank)

To aid consumers and small enterprises in India and Southeast Asia, Atlantis is a Singapore-based fintech firm.

These accounts allow customers to keep an eye on their balances as well as make payments and connect with the neobank more easily. It doesn’t matter if the purchase is for e-commerce, exercise, or personal care; the software will reward the user for it!

Disarray is engulfing the banking and FinTech industries” Financial decisions will be made in a single location during the next five or ten years. As the FinTech business matures and enters a phase of rapid re-bundling, it is becoming less disruptive. The second-order effect is characterized by its multidimensional nature.

Official Website – atlantistech.co

Check: All Banks Missed Call Balance Enquiry Number

10. PayZello

With this project, individuals will be able to discuss, suggest, and grasp financial data in a new way through new forms of banking. To put it another way, it acts as a knowledge center where individuals and organizations may exchange ideas, tips, and resources in order to grow and prosper.

Each category should have a spending restriction to ensure that money is used appropriately.

It’s easy to keep track of your expenses and investments with Payzello’s integrated cost management feature.

When it comes to mobile banking services, Payzello offers the most advanced AI and APIs available.

Official Website – payzello.com

Frequently Asked Questions

No, all of these are digital-only banks.

Yes, all of them are regulated by the Reserve Bank of India (RBI) and other authorities.

Yes, this is the main advantage of these banks. You can access them from anywhere using the Internet.

The documentation including KYC will take place online in case you are looking to open a bank account with these banks.

It depends on the bank you are opting for. All banks have different fees and charges.