LIC New Plans 2023 List: Check Best Life Insurance Plans to Invest this year

The Life Insurance Corporation (LIC) has launched a new term insurance plan named ‘Jeevan Kiran’ on 27 July 2023. One other plan namely New Jeevan Amar was also launched on November 23 , 2022. LIC is a reputed name that has already issued 21 million new individual policies. Hence, it’s indeed a wise decision to invest in LIC. Shared below is the full list of LIC new plans 2023.

Each individual’s insurance requirements and needs are different and hence sometimes it is quite difficult to choose a right LIC insurance plan best fit your needs. Introducing the LIC new plans 2023 list you must invest for a stable and worry-free future.

When it comes to select a right life insurance plan, LIC is the foremost choice of people. Undoubtedly, LIC is the most credible and trusted platform and we can’t ignore its immense popularity among people.

LIC offers a variety of insurance plans including Endowment Plan, Whole Life Plans, Money Back Plans, Term Assurance Plans, and Rider plans. Before I shall discuss LIC New Plans 2023, let’s talk about the different types of Life Insurance plans offered by LIC.

Categories of LIC Insurance Plans 2023 (LIC Plan Chart 2023)

Endowment Plan: The first one is Endowment Plan which combines both insurance as well as investment. The insured person will receive a lump sum by adding bonuses if applicable either on death event or policy maturity. Some of the best endowment plans introduced by LIC are as follows:

| Name of the product | Plan Number | UIN Number |

| LIC Aadhaar Shila | 944 | 512N309V02 |

| LIC Aadhaar Stambh | 943 | 512N310V02 |

| Lic Jeevan Labh | 936 | 512N304V02 |

| LIC Jeevan Lakshya | 933 | 512N297V02 |

| Lic Single Premium Endowment Plan | 917 | 512N283V02 |

| Lic New Bima Bachat | 916 | 512N284V02 |

| Lic New Jeevan Anand | 915 | 512N279V02 |

| Lic New Endowment Plan | 914 | 512N277V02 |

| LIC Bima Jyoti | 860 | 512N339V01 |

Whole Life Plans: Whole Life Plans are introduced to help your family when you are no more. The nominee is eligible to get the sum assured after the death of policy holder.

| Name of the product | Plan Number | UIN Number |

| LIC Jeevan Umang | 945 | 512N312V02 |

Money Back Plans: Unlike regular endowment insurance plans where the survival benefits are to be paid only at the completion of endowment period, this scheme offers periodic payments of partial survival benefits during the policy term.

| Name of the product | Plan Number | UIN Number |

| LIC’s Bima Shree | 948 | 512N316V02 |

| LIC’s Jeevan Shiromani | 947 | 512N315V02 |

| LIC’s Jeevan Tarun | 934 | 512N299V02 |

| LIC’s NEW CHILDREN’S MONEY BACK PLAN | 932 | 512N296V02 |

| LICs Jeevan Umang | 945 | 512N312V02 |

| LIC’s NEW MONEY BACK PLAN – 25 YEARS | 921 | 512N278V02 |

| LIC’s NEW MONEY BACK PLAN – 20 YEARS | 920 | 512N280V02 |

Term Assurance Plans: Term assured plans maintain the financial satiability of your family event after you. The sum insured is paid to nominee after the death of policyholder. Some of the best term assurance plans introduced by LIC is as follows:

| Name of the product | Plan Number | UIN Number |

| LIC’s Jeevan Amar | 855 | 512N332V01 |

| LIC’s TECH TERM | 854 | 512N333V01 |

Rider: Through this plan, a lump sum is paid to insured person’s nominee in case of untimely death of the policyholder. Check out few attractive rider plans introduced by Life Insurance Corporation of India.

| Name of the product | UIN Number |

| LIC’s NEW TERM ASSURANCE RIDER | 512B210V01 |

| LIC’s New Critical Illness Benefit Rider | 512A212V02 |

| LIC’s Premium Waiver Benefit Rider | 512B204V03 |

| LIC’s Accident Benefit Rider | 512B203V03 |

| LIC’s Accidental Death and Disability Benefit Rider | 512B209V02 |

| LIC’s Linked Accidental Death Benefit Rider | 512A211V02 |

Best LIC Life Insurance Plans to invest in 2023

Check out the LIC new plans 2023 list which comes with several attractive benefits at a nominal premium. These plans are beneficial for yourself and your family as well. It means the lump sum is paid to nominee even after insured’s death.

Here is the list of best LIC plans to invest in 2023:

LIC New Tech Term Plan

With LIC new tech term plan, you can get up to Rs.50 lakh coverage upon maturity just after investing Rs.4000/- annually. Your tentative premium is calculated here if you are 30 years old. Women can also grab special rates.

LIC new tech term plan was launched on 23rd November 2022 with its Plan No. 954 and UIN – 512N351V01. The policy allows you to choose from Single Premium, Regular Premium and Limited Premium Payment.

| Minimum age entry | 18 years (Last Birthday) |

| Maximum age entry | 65 years (Last Birthday) |

| Maximum age at maturity | 80 years (Last Birthday) |

| Minimum Basic Sum Assured | Rs. 50,00,000/ |

| Maximum Basic Sum Assured | No Limit (according to underwriting decision) |

| Policy term | 10 to 40 years |

LIC Bima Jyoti

LIC Bima Jyoti offers joint benefits of protection and savings. This plan also offers financial support to the family in case of unfortunate death of the policyholders during the term of policy and assured lumpsum to the surviving policyholder when the policy gets matured.

| Minimum Age at entry | 90 days |

| Maximum Age at entry | 60 Years (Age Nearer Birthday) |

| Minimum Age at the time of maturity | 18 years |

| Maximum Age at the time of maturity | 75 years (Age Nearer Birthday) |

| Term of policy | 15-20 years |

| Term of paying premium | Policy Term minus 5 Years |

| Minimum Basic Sum Assured | Rs. 1,00,000/- |

| Maximum Basic Sum Assured | No limit |

| Payment of premiums | Yearly, half-yearly, quarterly or monthly intervals (monthly premiums must be paid through NACH only) or through salary deductions. |

How to purchase LIC Bima Jyoti plan?

One can either purchase LIC Bima Jyoti plan online from the official website of LIC India www.licindia.in or though agent/other intermediaries in offline mode. Read all terms & conditions before you make purchase of the same.

Death Benefit

It includes two different conditions:

- On death during the policy term in prior the date of commencement of risk: The premium paid excludes extra premium, taxes and rider premium(s) would be returned.

- On death during the policy term after the date of commencement of risk: Sum Assured on Death” and Accrued Guaranteed Additions.

Maturity Benefit

The “Sum Assured on Maturity” along with guaranteed additions will be paid where “Sum Assured on Maturity” is equal to basic Sum Assured.

Facts- A LIC policyholder can request for a loan against his/her policy. In order to avail loan facility an individual must be at least 18 years old and a citizen of India. You can apply for loan against policy in online as well as offline mode. Please note, not all policies have loan facility. Please confirm before you apply.

LIC Jeevan Umang

LIC’s Jeevan Umang plan is conceptualized to offer you an accurate blend of income and protection to your family. The annual survival benefits is provided from the end of premium paying terms till the plan get matured and a lump sum is paid at the time of maturity or death of the policyholder during the term of policy.

| Minimum Age at entry | 90 days completed |

| Maximum Age at entry | 55 years |

| Minimum Age at the end of premium paying term | 30 years (nearest birthday) |

| Maximum Age at the end of premium paying term | 70 years (nearest birthday) |

| Age at the time the policy gets matured | 100 years (nearest birthday) |

| Term of policy | (100 – age at entry) years |

| Term of paying premium | 15, 20, 25 and 30 years |

| Minimum Basic Sum Assured | Rs. 2,00,000 |

| Maximum Basic Sum Assured | No limit |

| Payment of premiums | Yearly, half-yearly, quarterly or monthly intervals (monthly premiums must be paid through NACH only) or through salary deductions. |

How to purchase LIC Jeevan Umang?

It is possible to purchase LIC Jeevan Umang plan in online mode from the official website of LIC India www.licindia.in or through agent/other intermediaries in offline mode. Don’t forget to read all terms & conditions before you make purchase of the offered policy.

Death Benefits

You may fall under one of these two conditions:

- On death before the starting of Risk: premium/s paid without interest would be paid

- On Death after the starting of Risk: “Sum Assured on Death” along with vested Simple Reversionary Bonuses and Final Additional bonus, if any, would be paid.

Survival Benefit

A survival benefit equal to 8% of Basic Sum Assured would be paid per year if all due premiums are paid. You can expect payment of your first survival benefit payment at the end of premium paying term.

Maturity Benefit

“Sum Assured on Maturity” including vested Simple Reversionary Bonuses and Final Additional bonus, if any, would be paid if all due premiums are paid.

LIC Jeevan Amar

LIC Jeevan Amar is a kind of protection plan which provides the litheness to select from two different death benefit options- Level Sum Assured and increasing Sum Assured. Two different categories of rates are introduced under this plan- Non-smoker rates and Smoker rates. There are also lower premium rates applicable for female proposers.

Death Benefits

The amount shall be payable on death depends upon Death Benefit Option selected at the time of taking this policy. It won’t be possible to change Death Benefit Option once selected. The different death benefit options are as follows:

Option I: Level Sum Assured

Absolute amount assured shall be payable on death is equal to Basic Sum Assured, which will remain same throughout the term of policy.

Option II: Increasing Sum Assured

Absolute amount assured shall be payable on death remains equal to Basic Sum Assured till completion of fifth policy year. Further, it will increase by 10% of Basic Sum Assured each year from the sixth policy year till fifteenth policy year till it becomes twice the Basic Sum Assured. The increase will remain in force till the date of death or end of policy term or till the fifteenth policy year, whichever is earlier. Later, the Absolute amount assured shall be payable on death remains constant.

Maturity Benefit

No Maturity Benefit is applicable on the Life Assured surviving.

How to purchase LIC Jeevan Umang?

You can either visit the official website of LIC to purchase LIC Jeevan Umang plan or else you can purchase it in offline mode through agent/other intermediaries. Please do read the related terms before you purchase.

Facts: LIC is the most preferred and trusted platform to purchase life insurance policies. LIC has its amazing footprint in rural as well as urban areas.

LIC New Jeevan Anand

LIC New Jeevan Anand Plan offers you a complete package of protection and saving. The financial protection against death is offered throughout the lifetime of the insured. This plan is also capable to take care of liquidity requirements through its loan facility.

Eligibility and Restrictions

| Minimum entry age | 18 years (completed) |

| Maximum entry age | 50 years (nearer birthday) |

| Maximum age at maturity | 75 years (nearer birthday) |

| Minimum Basic Sum Assured | Rs. 100000/- |

| Maximum Basic Sum Assured | No limit |

| Minimum Policy Term | 15 years |

| Maximum Policy Term | 35 years |

Death Benefit

In case of death during the term of policy the Sum Assured on Death including vested Simple Reversionary Bonuses and Final Additional bonus would be paid if all premium dues are cleared.

In case of death after the term of policy Basic Sum Assured would be paid.

It is possible to make payment of premiums at yearly, half-yearly, quarterly or monthly intervals (through NACH only) or through salary deductions over the policy term.

Health Plans by LIC

This post is dedicated to provide you complete LIC new plan list 2023 which also includes health plans offered by LIC.

LIC Jeevan Arogya

LIC Jeevan Arogya offers health insurance cover against certain specified health risks and assistance in case of medical emergencies. This plan helps you to be financially independent in difficult times.

Features of LIC Jeevan Arogya

- Make you financially independent in case of hospitalization, surgery etc.

- No claim benefit included

- Get an increased health cover every year

- Lump sum benefits would be added irrespective of medical costs

- Flexible options for making payment of premiums

- You can choose from flexible benefit limit

- Extremely simple to choose your plan

Who will be insured under this policy?

You (as Principal Insured) along with your parents, spouse, children, parents of your spouse all will be insured under one policy. The minimum and maximum entry age is as follows:

| Minimum entry age | Maximum entry age | |

| Self / spouse | 18 years | 65 years (last birthday) |

| Children | 91 days | 17 years (last birthday) |

| Parents / parents-in-law | 18 years | 75 (last birthday) |

How long will be insured?

Eligible persons are insured up to the age of 80 years. In case of children, they are insured up to age 25 years.

Notable benefits of LIC Jeevan Arogya

- Premium waiver Benefit (PWB)

- Ambulance Benefit

- Hospital cash benefit (HCB)

- Day care procedure benefit

- Major surgical benefit (MSB)

- Other surgical benefit

*Loan facility under LIC Jeevan Arogya: Sorry there is no loan facility under this plan.

Facts- LIC may launch many new insurance plans in 2023. For the same, you should keep your close eyes on LIC official website or you can ask authorized agent/other intermediaries regarding new policies launched by LIC.

LIC Cancer Cover

It is a regular premium payment health insurance plan which offers you financial stability in case of Early and/or Major Stage Cancer during the term of policy.

Benefits Offered

Early Stage Cancer

- Lump sum benefit: 25% of Applicable Sum Insured would be paid

- Premium Waiver Benefit: Premiums for the upcoming there years or balance policy term whichever is less, would be waived off.

Major Stage Cancer

- Lump sum benefit: 100% of Applicable Sum Insured minus paid claims is payable

- Premium Waiver Benefit: The upcoming premiums are waived off from the next policy anniversary.

- Income benefit: 1% of Applicable Sum Insured

Eligibility criteria

| Minimum entry age | 20 years should be completed |

| Maximum entry age | 65 years (last birthday) |

| Minimum age at maturity | 50 years |

| Maximum age at maturity | 75 years |

| Minimum policy term | 10 years |

| Maximum policy term | 30 years |

| Minimum premium to be paid | Rs. 2400/- for all modes |

| Minimum Basic Sum Insured | Rs.10,00,000/- |

| Maximum Basic Sum Insured | Rs. 50,00,000/- |

| Payment of premiums | Regularly at yearly or half- yearly mode |

New Pension Plans by LIC in 2023

Are you keen to know about the LIC new plans in 2023? Below you can find details of trending pension plans offered by LIC.

LIC New Jeevan Shanti

LIC New Jeevan Shanti gives you options to choose between Single life and Joint life Deferred annuity. One can purchase this plan in offline mode through agent/other intermediaries or from the official website of LIC in online mode.

LIC New Jeevan Shanti Quick Overview

| Minimum entry age | 30 years (Last Birthday) |

| Maximum entry age | 79 years (Last Birthday) |

| Minimum purchase price | Rs.1,50,000 subject to minimum Annuity |

| Maximum purchase price | No limit |

| Minimum vesting age | 31 years (Last Birthday) |

| Maximum vesting age | 80 years (Last Birthday) |

| Minimum Annuity | Monthly- Rs.1000/- Quarterly- Rs.3000/- Half-yearly- Rs.6000/- Per annum- Rs.12000/- |

| Mode of Annuity Payment | Yearly, half-yearly, quarterly and monthly |

| Minimum Deferment Period | 1 year |

| Maximum Deferment Period | 12 years |

New/Trending Unit Plans by LIC in 2023

Unit plans are introduced by LIC for those who understand the true value of hard-earned money. These plans help you to grab amazing benefits on your saving and save tax even you don’t have a consistent income.

LIC Nivesh Plus

LIC Nivesh Plus is a trending single premium life insurance plan which offers you insurance cum investment cover throughout the policy term. Interested individual can buy this plain online from the official website of LIC or else they can simply contact agent/other intermediaries to buy this plan. You have flexibility to select basic Sum Assured at the inception:

Option 1: 1.25 times of Single Premium;

Option 2: 10 times of Single Premium

*Option once selected won’t be altered.

Eligibility & Restrictions under LIC Nivesh Plus

| Minimum entry age | 90 days should be completed for Option 1 and 2 |

| Maximum entry age | 70 years (nearer birthday) for Option 1 35 years (nearer birthday) for Option 1 |

| Minimum age at maturity | 18 years should be completed |

| Maximum age at maturity | 85 years (nearer birthday) for Option 1 50 years (nearer birthday) for Option 1 |

| Minimum premium | Rs. 1,00,000/- |

| Maximum premium | No Limits |

| Mode of paying premium | Single premium only |

| Minimum/Maximum Basic Sum Assure | Option 1: 1.25 times of the single premium Option 2: 10 times of the single premium |

Death Benefits

- On death before the Date of starting of Risk: An amount equal to the Unit Fund Value

- On death after the Date of starting of Risk: An amount equal to the higher of Basic Sum Assured minus Partial Withdrawals or Unit fund value.

Maturity Benefits: An amount equal to Unit Fund Value would be paid.

Facts: An individual can purchase LIC life insurance policies online through its official website or they may directly contact authorized agents/other intermediaries for buying a new policy.

LIC SIIP

LIC SIIP is a regular premium individual life insurance plan which provides insurance cum investment throughout the policy term. You can purchase this plan easily from the official website of LIC or connect to an agent/other intermediaries for making a purchase.

Eligibility & Restrictions under LIC SIIP

| Minimum entry age | 90 days should be completed |

| Maximum entry age | 65 years (nearer birthday) |

| Minimum age at maturity | 18 years should be completed |

| Maximum age at maturity | 85 years (nearer birthday) |

| Term of policy | 10 to 25 years |

| Term of premium paying | As per the policy term |

| Payment of premiums | Yearly, half-yearly, quarterly or monthly(through NACH only) |

| Minimum premium | Yearly- Rs. 40,000 Half-yearly-Rs. 22,000 Quarterly-Rs. 12,000 Monthly- Rs. 4,000 |

| Maximum premium | No limit |

| Minimum/Maximum Basic Sum Assured | Age below 55 Years- 10 times of Annualized Premiums Age 55 years and above- 7 times Annualized Premiums |

Death Benefits

- On death before the Date of starting of Risk: An amount equal to the Unit Fund Value

- On death after the Date of starting of Risk: An amount equal to the higher of Basic Sum Assured minus Partial Withdrawals or Unit fund value or 105% of the total premiums received up to the date of death minus partial withdrawals.

Maturity Benefits: An amount equal to Unit Fund Value would be paid.

Also check: world’s richest actresses

Group Schemes offered by LIC

Group schemes validate protection to groups of people. These schemes are considered ideal for employers, associations, societies etc. and permit you to enjoy group benefits at an affordable cost.

LIC Group Credit Life Insurance

LIC Group Credit Life Insurance is a single premium group term insurance plan which offers insurance cover on death of the group member during the term of policy.

Eligibility and Restrictions

| Minimum entry age | 18 years should be completed |

| Maximum entry age | 60 years (nearest birthday) |

| Maximum age at maturity | 65 years (nearest birthday) |

| Term of policy | 5 to 35years |

| Minimum Sum Assured | Rs.400000/- |

| Maximum Sum Assured | No limit |

| Premium payment mode | Single premium only |

| Minimum group size | 50 members |

| Loan facility | No |

Death Benefit

A sum assured according to the risk covered would be paid.

Maturity Benefit

Nothing would be paid on survival at the end of the term of policy.

LIC SINGLE PREMIUM GROUP INSURANCE

LIC SINGLE PREMIUM GROUP INSURANCE is a single premium group term insurance plan which offers a flat life cover on death of the group member during the term of policy.

Eligibility and Restrictions

| Minimum entry age | 18 years should be completed |

| Maximum entry age | 60 years (nearest birthday) |

| Maximum age at maturity | 65 years (nearest birthday) |

| Term of policy | 2 to 7 years |

| Minimum Sum Assured | Rs.5000/- |

| Maximum Sum Assured | Rs. 10,00,000/- |

| Premium payment mode | Single premium only |

| Minimum group size | 50 members |

| Loan facility | No |

Death Benefit

A sum assured in respect of the particular member would be paid.

Maturity Benefit

Nothing would be paid on survival to the end of the term of policy.

Facts- List of products offered by Life Insurance Corporation of India includes Insurance plan, Pension plan, Unit linked plans, Micro insurance plans, and health insurance plans.

Also check: Government Schemes in India

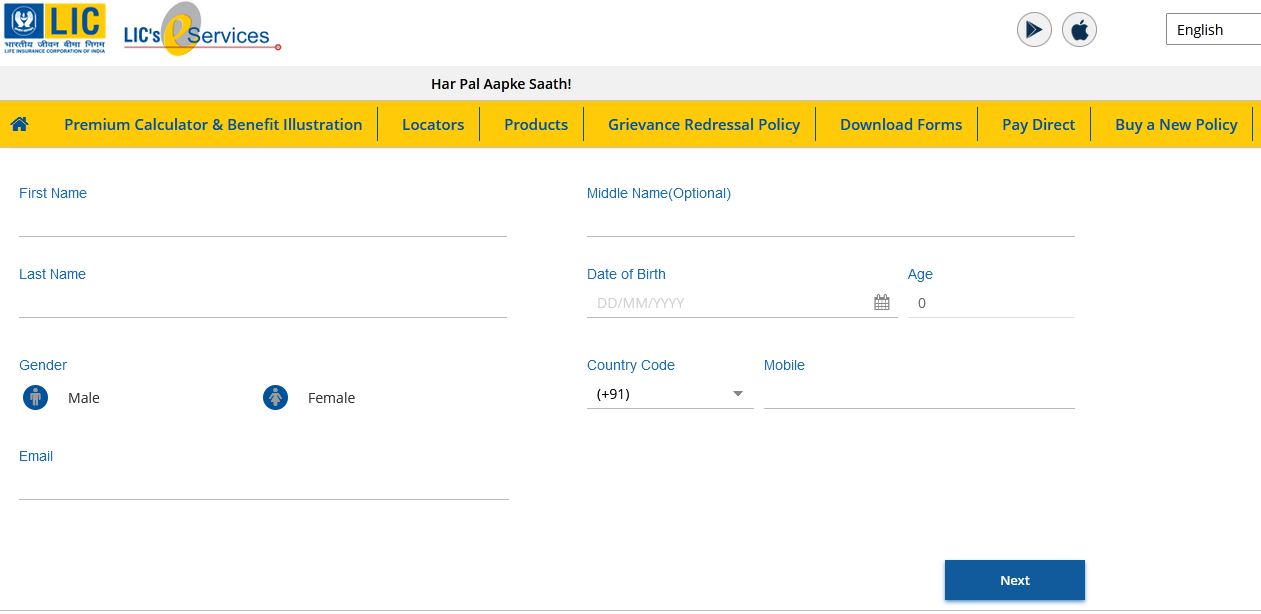

LIC Premium Calculator

The Life Insurance Corporation of India offers premium calculator using which you can calculate your LIC policy premium.

You’ll be asked to enter your first name, middle name, last name, date of birth, gender, mobile number, and email. After entering these details you need to click next button to choose the product. Follow the on-screen instructions to calculate the premium.

Check LIC Policy Status

Hope you have gone through LIC new plans 2023 list and made purchase of a new policy. Now, you might be excited to know your LIC policy status. You can check your LIC policy status online through the official website of LIC India.

New customers have to go through an online registration module. You can easily register by following the tips provided below:

- Please visit the official website of LIC India and go to the login panel available at home page.

- Please fill the registration form online and choose username and password of your choice. Your username may be alpha, numeric, along with characters, dot and underscore. Your selected password must be of 8 to 30 characters.

- After a successful registration, you’ll be able to check your policy status, premium due/ policy calendar, loan, revival, maturity calendar etc.

Frequently Asked Questions

Question: How to purchase a new LIC life insurance plan?

Answer: You can browse all plans of LIC online at its official website and make purchase of the same. Or else, you need to contact agent/other intermediaries to purchase a new life insurance plan from LIC.

Question: Can I pay my LIC premium online?

Answer: Of-course! You can easily pay your LIC premium online through internet banking.

Question: Is Single mandate sufficient for multiple policies?

Answer: No, separate mandate is compulsory for each policy.

Question: My payment is successful, amount debited but I haven’t received the e-receipt?

Answer: Sometime it happens due to session timed out or other technical issues. Your e-receipt is usually generated within 3-4 days after the payment is received. However, if it’s been more than a week then please send the bank details along with bank statement to [email protected].

Question: I forgot my online login password, how to reset them?

Answer: Please use forgot password option available at login page and follow on-screen instructions to reset your password.

Question: My amount is debited but the premium is not yet adjusted?

Answer: If it’s been more than 10 days that your premium is not adjusted then please contact your banker.

Download LIC Forms for Claims, Revival, IPP-ECS Mandate

| Death Claims | Download now |

| Maturity Claims | Download now |

| Survival Benefit Claims forms | Download now |

| Revival of Lapsed policy Form no. 680 | Download now |

| Revival of Lapsed policy – Form no. 700 | Download now |

| Revival of lapsed Policy- Form no. 720 | Download now |

| IPP-NEFT MANDATE FORM | Download now |

| Certificate of Existence | Download now |

| IPP-Letter of Indemnity | Download now |

| Neft Mandate Form | Download now |

| Health Insurance Forms | Download now |

| Pre-contract Integrity Pact | Download now |

Facts- An individual must take an insurance plan for a happy and protected life. As per the source, only 44% Indians have a health cover and this need to be increased in the least possible time.

LIC Helpline Number

24*7 Phone helpline number- 022 6827 6827

Grievance Redressal Officers :

For any policy related grievance, please contact Grievance Redressal Officers at Branch / Division / Zonal / Corporate Level.

SMS LICHELP :

SMS LICHELP <pol.no.> to 9222492224 or SMS LICHELP <pol.no.> to 56767877

Helpline number for Health Insurance policies: 18004259876 (from 10 AM to 5 PM on all working days)

Summary

Through this post, my motive is letting you know LIC new plans 2023 list including trending plans offered by Life Insurance Corporation of India. LIC has a number of life insurance plans to choose from and more are to be added in future. I do have provided details regarding how can you check your policy status, how to calculate your LIC premium, how to download claim, Revival, IPP-ECS Mandate forms and how can you contact LIC helpline team for certain queries.

Thanks for reading this article. I’ll also add new LIC insurance plans to be launched in the coming months. If you have any concern(s), please share it through the comment box below.