Sukanya Samriddhi Yojana 2024-25: Age Limit, Application Process, Interest Rate, Benefits, Maturity, Withdrawal

On 22 January 2015, Prime Minister Narendra Modi launched the Sukanya Samriddhi Yojana to help Parents secure future education of their girl children. One can open a Sukanya Samriddhi account in Post office and authorized banks.

Sukanya Samriddhi Yojana is one of the best saving schemes available today offering an interest rate of 8%.

The account norms of Sukanya Samriddhi Yojana were revised in 2019 and what was revised is as follows:

- Point 1: Initially, the minimum and maximum investment for this scheme were Rs. 1000 and Rs. 1,50,000 respectively in one financial year.

- Point 2: The minimum investment was revised from Rs.1000 to Rs.250 in one financial year (applicable from the financial year 2018-19). However, if you fail to deposit at least Rs.250 in one financial year then a fine of Rs. 50/- will be added.

Sukanya Samriddhi Yojana (2024) – Summary

| Scheme Name | Sukanya Samriddhi Yojana (SSY) |

| Launch Date | 22 January 2015 |

| Launched by | Prime Minister Narendra Modi |

| Girl’s minimum age for opening SSY account | Soon after birth |

| Girl’s maximum age for opening SSY account | 10 years |

| Minimum deposit | Rs.250 per year |

| Maximum deposit | Rs.1,50,000 per year |

| Interest Rate | 8% |

| No. of accounts allowed | Two |

| Maturity period | 21 years from the date of opening of account |

| Tax benefits | Yes |

Sukanya Samriddhi Yojana Age Limit

Who is eligible: Only a girl child is allowed to avail the matchless benefits of this yojana.

Age limit: You can open a Sukanya Samriddhi account soon after the birth of your girl child till she attains an age of 10 years. Your child may get 1 year of grace period with valid reason.

How many accounts a Parent can open: You can open accounts for maximum two girl children (please note you can open one account per child). You are allowed to open three accounts in case of twins or triplets.

Who can open an SSY account: You must be either a legal guardian or biological parent of a girl child. Only an Indian citizen is allowed to open the account.

How to open a Sukanya Samriddhi Account?

You can open a Sukanya Samriddhi Account either in post office or authorized banks.

However, it will not be convenient for you to visit the bank or post office every month to deposit money into your SSY account. In that case, you should open your SSY account in the bank where you already have a savings account.

It doesn’t mean that you can’t deposit online in case you open your SSY account in post office. However, for the same you’ll need to open an Indian Post Payments Bank (IPPB) account first before opening a SSY account in the post office. The post office staffs will help you to open your IPPB and SSY account together so that you can link both the accounts and deposit your investment online.

Process to open a Sukanya Samriddhi Account in Bank

The Government of India has authorized a few banks where you can open your Sukanya Samriddhi account. The list of authorized banks includes:

- SBI

- ICICI Bank

- Union Bank of India

- United Bank of India

- Axis Bank

- IDBI Bank

- Vijaya Bank

- Oriental Bank of Commerce

- PNB

- Indian Bank

- Dena Bank

- Syndicate Bank

- UCO Bank

- Central Bank of India

- BOI

- Indian Overseas Bank

- Corporation Bank

- Canara Bank

- Allahabad Bank

- Bank of Maharashtra

- Andhra Bank

- Bank of Baroda

- Punjab and Sind Bank

You can visit the bank where you already have a savings account and submit your Sukanya Samriddhi Yojna application form with valid documents. You can download the SSY application form online from the bank’s official website or collect it from your bank.

Process to open Sukanya Samridhi Account in post office and link it to Indian Post Payments Bank for Online Deposits

You need to fill a separate form for the both Indian Post Payments Bank account and Sukanya Samriddhi account in post office.

Further, you need to download the IPPB app to make online deposits directly to your SSY account.

Note: With Indian Post Payments Bank account you can easily transfer money online, make bill payments, and others.

Step 1: Download the IPPB app to your Smartphone.

Step 2: Now you need to register on IPPB app using information such as your account number, customer ID, date of birth, and mobile number registered with Indian Post Payments Bank (IPPB).

Your account number and customer ID are provided by your post office and are also written in your passbook.

Step 3: Soon you click the Register button; you’ll be taken to the next page where you need to answer few security questions as follows:

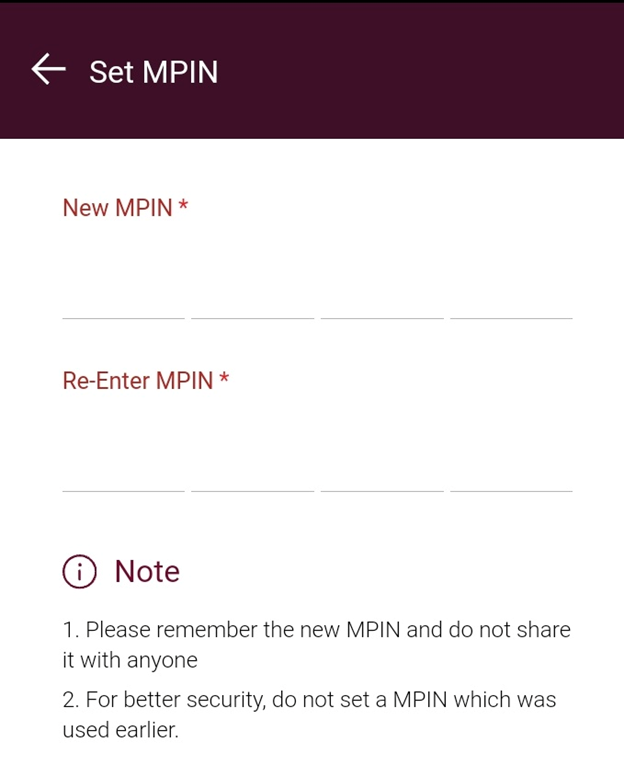

Step 4: Upon clicking the Submit button, you’ll be asked to create an MPIN for future logins. You can create the 4-digit MPIN of your choice.

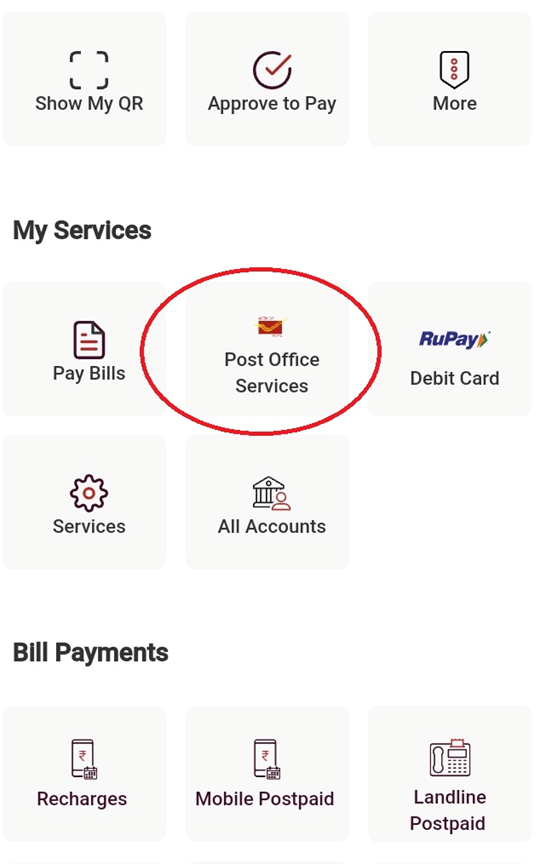

Step 5: Now, login to your IPPB account using the MPIN and click ‘Post Office Services’ under ‘My Service’ section.

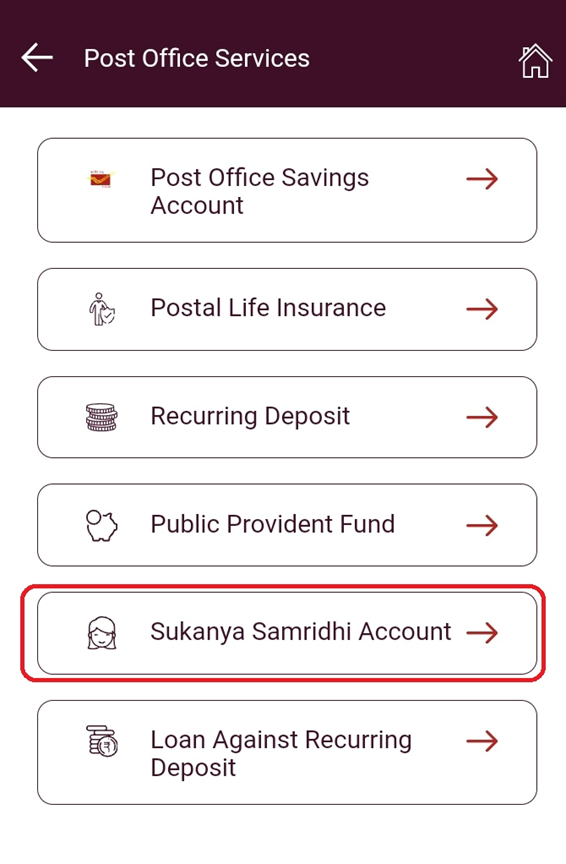

Step 5: Next, you need to select ‘Sukanya Samridhi Account’.

Step 6: You’ll be taken to the Sukanya Samriddhi Account page where you need to enter your SSA Account Number and DPO Customer ID.

Here,

SSA Account Number is your Sukanya Samriddhi Yojana account number provided by your post office.

DOP Customer ID: It is your daughter CIF provided by your post office.

Finally, login to your Sukanya Samriddhi Yojana account and make deposit from your IPPB account.

Note: You can also enable Standing Instructions (SI) to your saving account so that a specific amount will be deducted and added to your SSY account every month.

Sukanya Samriddhi Yojana Application Form and Required Documents

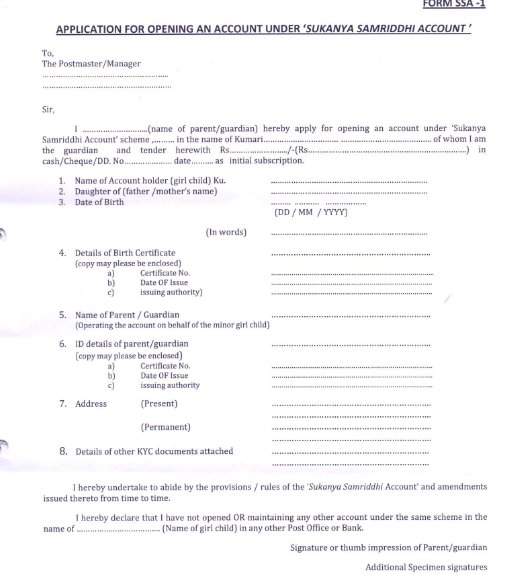

Have a look at Sukanya Samriddhi Yojana application form:

Following details are to be filled in your SSY application form:

- Your daughter name;

- Father’s or Mother’s name;

- Date of birth of your child;

- Birth certificate details such as Certificate number, Date of Issue, and Issuing Authority;

- Name of Parent/Guardian operating the account of the child;

- Parent/Guardian ID details;

- Current and permanent address;

- Details of KYC documents attached;

Submit your duly-filled SSY application form to your bank or post office with following documents:

- Birth certificate of your child;

- ID proof of parent/guardian;

- Address proof of parent/guardian;

Sukanya Samriddhi Yojana Interest Rate Calculation

The interest rate for Sukanya Samriddhi Yojana changes with time. The interest rate for the financial year 2023-24 is 8%. I have shared below the changes in the interest rates in the last few years:

| Financial Year | Interest Rate |

| 2023-24 | 8% |

| 2022-23 | 7.6% |

| 2021-22 | 7.6% |

| 2020-21 | 7.6% |

| 2019-20 | 8.4% to 8.5% |

| 2018-19 | 8.1 % to 8.5% |

| 2017-18 | 8.1 % |

Let’s understand through an example that how interest is calculated on your deposits in Sukanya Samriddhi account:

Suppose you make:

Yearly Investment= 30,000

Your daughter’s age= 2 years

You start in the year 2023.

Hence, the total investment you’ll make is around 4,50,000 and you’ll get 13,46,907 as the maturity amount.

Note: This is just a rough calculation. The actual data may differ from it.

Notable Benefits of Sukanya Samriddhi Yojana

“You just need Rs.250 to open a Sukanya Samriddhi account. The more you deposit more your child will get upon maturity. However, make sure that the deposit must not exceed Rs. 1,50,000 in one financial year.”

“You can withdraw 50% of the amount when your daughter turns 18 to cover her educational expenses.”

“You can claim tax benefits under Section 80C of Income Tax Act.”

“It is the most affordable way of saving for your daughter.”

“You’ll get assured returns upon maturity.”

Top 5 States with Highest Number of Sukanya Samriddhi Accounts

Uttar Pradesh is the state with the highest number of Sukanya Samriddhi accounts as on 31st December 2022 followed by Tamil Nadu, Maharashtra, Madhya Pradesh, and Karnataka.

- Uttar Pradesh has 36,07,698 Sukanya Samriddhi accounts.

- Tamil Nadu has 31,38,182 Sukanya Samriddhi accounts.

- Maharashtra has 28,75,136 Sukanya Samriddhi accounts.

- Madhya Pradesh has 25,27,795 Sukanya Samriddhi accounts.

- Karnataka has 24,48,215 Sukanya Samriddhi accounts.

Sukanya Samriddhi Yojana Withdrawal Process

You can withdraw 50% of the total amount for education purposes when your daughter becomes 18 years old. However, you have to submit the proof of admission.

Your SSY account becomes mature after 21 years from the date of opening of account. Your daughter can withdraw the full amount with interest upon maturity after submitting the required documents including withdrawal form, ID proof, and address proof.

You need to make deposit till 15 years from the date of opening of account.

If your daughter gets married soon she completes 18 years then it is possible to close the account normally and withdraw the amount.

In case of death of the child, the account will be closed after submitting the death certificate and the amount will be transferred to the nominee.

FAQs

Yes

You need to pay 15 years from the date of opening of your account.

No, the maximum deposit must not cross Rs.1,50,000 per year.

You can open your SSY account in authorized banks and post office.

Yes

Birth certificate of your child and address and ID proof of parent/guardian

Have questions in your mind? Write to me through the comment box below and I am here to answer all your queries.